If you have been watching the news over the last couple of years, you may have heard of the SECURE Acts. These acts were meant to “beef up” retirement plans and access for Americans. Our nation is in a retirement crisis. Only about 50% of households reported having any retirement savings in 2019. Less than a quarter of Americans have more than $100,000 in retirement savings, and less than 8% have more than $500,000. According to recent data from the Federal Reserve, the average American only has around $65,000 in retirement savings.

More and more people are growing concerned about the Social Security benefits system, and how it will impact them in the future. Congress also has been trying to forestall this crisis and has focused much effort on lifetime income. While employers offer vehicles for retirement saving during working years, Congress is now pushing them to offer help in the decumulation stage of retirement by developing avenues for employees to receive income during their retirement years that, hopefully, they will not outlive.

Previously, the primary focus has been saving for retirement (or the need to save for retirement). As this has yet to take hold with Americans—as demonstrated by only 50% having retirement savings—it is essential to note the importance of saving for retirement and the need to start immediately. Many people don’t realize just how much money they need to save to prepare for a comfortable retirement.

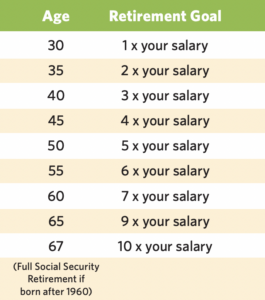

An adequate amount requires around 80% of your yearly income in retirement, but how do you figure out the lump sum that will produce that 80% needed? A simple savings breakdown goal chart would make it easier to target your number.

While this is not an exact system, it will at least get you headed in the right direction. The focus of the retirement industry for several years has been set on the accumulation of assets. But with the recent acts being passed by Congress, the retirement industry must now shift its focus to the decumulation side of retirement planning, as well.

For Free Will Baptists, this is an area where we have been working since the 1980s. During that time, the Board of Retirement established our annuity program. This program operates differently than the deferred annuities one would purchase through a bank or financial advisor. Our program was set up as an immediate annuity, starting when the participant transferred into the pool. The objective was to provide our pastors and employees with a way to decumulate assets throughout their lifetimes.

Congress and the rest of the retirement industry are now trying to create options Free Will Baptist employees have had since the 1980s. Guaranteed lifetime income is essential to ensure retirees will not outlive their assets in retirement.

Our office is here to help! Feel free to contact us if you would like more information on options for the decumulation of assets.

This article was previously posted in the October/November 2023 edition of ONE Magazine.