Investing in Gold. One of the most common questions that I get asked as I travel around is what do you think about investing in gold. Many fans of gold argue that the metal will protect (hedge) against inflation and stock market disaster. Some believe that gold or silver will always be of value no matter what comes of the economic outlook; while other investors believe that gold has no place in a modern portfolio. Warren Buffet falls into the camp of gold having no place in a modern portfolio if his opinion carries any weight with your ideals of investment.

Investing in Gold. One of the most common questions that I get asked as I travel around is what do you think about investing in gold. Many fans of gold argue that the metal will protect (hedge) against inflation and stock market disaster. Some believe that gold or silver will always be of value no matter what comes of the economic outlook; while other investors believe that gold has no place in a modern portfolio. Warren Buffet falls into the camp of gold having no place in a modern portfolio if his opinion carries any weight with your ideals of investment.

From a practical stand point, other than being used for jewelry and some industrial applications the metal itself holds no intrinsic value. Holding the metal also produces no additional income. Over the long-term, gold is no match to a diversified investment portfolio. For example: If you bought gold in 1986 and held it until 2016 your value would have increased 200% over the 30 years. At the same time if you would have invested in the Dow Jones Industrial Index your value would have increased 900%.

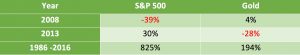

While in any given year gold may outperform the equity market, the reverse can also be true. In 2008, the S&P 500 fell -39% during one of the worse recessions since the Great Depression, whereas gold increased 4%. Although in 2013, the S&P 500 returned 30% and gold fell -28%. Gold fans usually overlook the downturns in gold and just compare them to the downturn in the markets. Over a 30 year comparison, the S&P is up 825% to gold at 194% giving up a 631% return on your initial investment.

*goldprices.org. Morningstar

*goldprices.org. Morningstar

If you are dead set on owning gold then the safer/cheaper approach is to purchase an ETF backed by precious metal, i.e., SPDR Gold Trust (GLD), which has an expense ratio of 0.40%. This will allow you to hold the precious metal in your portfolio but retain some liquidity in your investment so that if the need comes to sell your investment you will be exposed to the going market rate rather than a cash for gold dealer.