Remember what the world was like in 2019? Unemployment reached an all-time low, the economy was booming, businesses hadn’t been shut down due to a worldwide pandemic, and no one needed to shelter in place. Sadly, in early 2020, all of that changed. Now, we are searching for a new normal as we emerge slowly from an international crisis. This “new normal” will affect all areas of our lives in ways we never before considered.

Remember what the world was like in 2019? Unemployment reached an all-time low, the economy was booming, businesses hadn’t been shut down due to a worldwide pandemic, and no one needed to shelter in place. Sadly, in early 2020, all of that changed. Now, we are searching for a new normal as we emerge slowly from an international crisis. This “new normal” will affect all areas of our lives in ways we never before considered.

As I write this article, many questions remain unanswered about how businesses will protect customers in the future, helping them feel safe in crowds of people. The financial repercussions of the global economic shutdown will likely trickle down for years to come as the government stimulus is unwound from the economy. It also means changes to our financial plans moving forward, personally as well as for businesses and ministries. This pandemic has revealed the fragile financial picture of many Americans while stressing existing finances.

While the government stepped in at the onset of the pandemic and propped up the economy with stimulus money for individuals and businesses, unemployment still rose sharply, and companies that couldn’t weather the shutdown were forced to close. Individuals were forced to tap savings accumulated over the years. Some wiped out emergency funds and withdrew retirement savings to make ends meet.

Many families went from two incomes to no income in a very brief period. For families living paycheck to paycheck (78% of U.S. workers, according to a survey by CareerBuilder), this quick collapse of income resulted in high stress and worry. One in four workers had no funds set aside in savings. Thus, they had no safety net when they lost their jobs. Since many had no savings, they turned to credit card debt to sustain them until they received unemployment or stimulus money.

As social restrictions ease and the economy gradually reopens, those who were unprepared face a mountain of debt on top of everything else. They learned the hard way how fragile the economy and their livelihoods could be.

This is extraordinary year for the economy reminded us that even a few weeks of businesses being closed results in huge numbers of layoffs and complete disruption of normal, everyday life. As with any crisis, new knowledge is gained through the experience to help us prepare for the next major crisis.

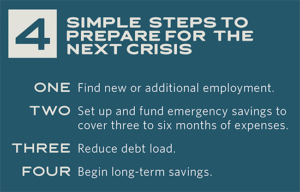

This starts with resolving the issues accumulated during the most recent crisis. Find new or additional employment, set up and fund emergency savings to cover necessary expenses for three to six months, and reduce your debt load. Also, begin long-term savings at an adequate rate so as you age, your retirement years are not a stressful event. The better we prepare financially, the less stress we will feel the next time a crisis happens, whether a global pandemic or a personal crisis such as the loss of a job.

Rebuilding from COVID-19 will require deliberate savings and retirement goals and paying down credit card and other debt to a manageable level. It will be a long road to financial recovery, but the lessons learned from this crisis will help us be better prepared for the next big crisis.