Financial crises arise in everyone’s life. Good financial wisdom tells us we should have an emergency fund for those rainy days. But that’s a tall order for many, especially in today’s economy. More and more people are making a very painful mistake. They cash out their retirement funds early. For many, cashing out their retirement seems like a relatively easy way to solve a short-term problem, whether to pay down debt, cover a home repair, help with children’s college tuition, or increase cash flow after losing a job. Others cash out just because they are changing jobs. While doing so may provide a pool of money, an early withdrawal (before age 59½) is very costly.

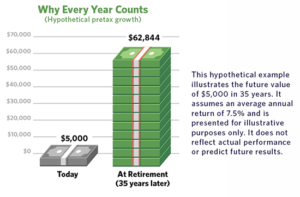

One long-term consequence of cashing out early is the loss of future growth. After you cash out those retirement savings, they’re gone, and they can be very challenging to replace. With retirement plans, your contributions have the potential to compound without taxes eroding their growth. Over time, earnings generate their own earnings, gradually building your retirement savings. Remember, seemingly inconsequential dollar amounts compounded over many years can grow into significant retirement savings. (See the illustration above.)

One long-term consequence of cashing out early is the loss of future growth. After you cash out those retirement savings, they’re gone, and they can be very challenging to replace. With retirement plans, your contributions have the potential to compound without taxes eroding their growth. Over time, earnings generate their own earnings, gradually building your retirement savings. Remember, seemingly inconsequential dollar amounts compounded over many years can grow into significant retirement savings. (See the illustration above.)

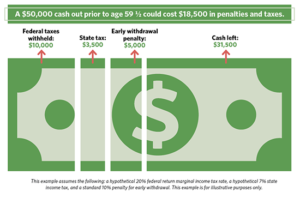

You also face an immediate consequence for withdrawing your retirement early: taxes and a penalty. When you cash out before age 59½, your plan administrator is required to withhold 20% of your withdrawal for taxes to the IRS. (And, depending on the state where you live, you may owe state income taxes.) In addition, cashing out early means you will have to pay a 10% early withdrawal penalty. That is a big chunk (30%) of the money you have saved for retirement that’s gone and will never have the ability to grow.

When you’re backed into a corner, it may be tempting to fall back on an early withdrawal from your retirement account. Don’t give in to temptation and devastate your future earnings. It’s your retirement account for a reason. Keep a long-term perspective. Carefully consider the consequences of taking an early withdrawal so you don’t lose money and time for potential growth like. Stay invested, keep saving, and plan ahead. Your future self will thank you.

When you’re backed into a corner, it may be tempting to fall back on an early withdrawal from your retirement account. Don’t give in to temptation and devastate your future earnings. It’s your retirement account for a reason. Keep a long-term perspective. Carefully consider the consequences of taking an early withdrawal so you don’t lose money and time for potential growth like. Stay invested, keep saving, and plan ahead. Your future self will thank you.